360° SPONSORED CONTENT

Fundraising in 2021 comes with its own unique set of challenges.

There’s been a lot of talk about the Great Transfer of Wealth, and how this 1-trillion dollar change of hand will disrupt the Canadian nonprofit sector. In fact, a 2019 report by Coldwell Banker pinpoints that by 2030, millennials will hold 5x as much wealth as they do today.

This is important when you consider Millennials are also now the largest generation of Canadians, accounting for 27% of the country’s population. And what we’ve learned is that while Millennials give just 42% the amount Baby Boomers do, their donations cause real, tangible change.

With this shift in generational wealth coupled with the move towards digitization, we’re seeing a shift in how giving takes place. Philanthropy is changing, and while donation amounts are getting smaller, cause-based awareness, mobilization, and the sheer volume of donations are rising.

This can all be boiled down to the rise of microdonations.

Why are microdonations important?

Microdonations are gifts between $0.25 and $25. And what these gifts lack in revenue, they make up for in impact - both for organizations and for the wider landscape of donors.

The importance of microdonations is contributing to the democratization of philanthropy, as well as the promotion of sustainable, diverse revenue models. For donors, it opens up philanthropy by making it accessible to a wider array of Canadians, regardless of socioeconomic status (sometimes these gifts are so small, that many donors will give them without a second thought).

For organizations, a $1 gift won’t change much, but 1,000 $1 donations could. Plus, since these donations may come from an audience outside your standard donor pool, you’re not only reaching new donors, but you’re protecting your organization’s finances from changing economic conditions. As your donations are coming in from such a wide base, these changes are less likely to affect all of them, safeguarding some revenue streams.

Understanding the impact of microdonations

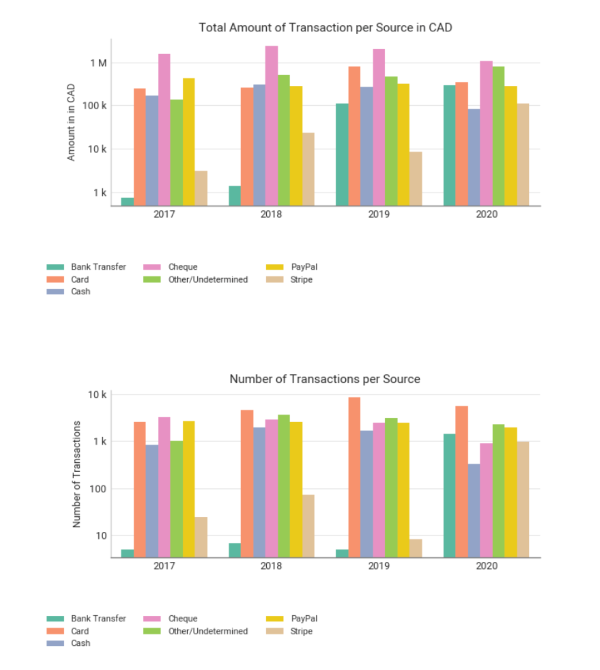

With smaller donations growing in popularity, the platforms people are giving on are beginning to shift. The figures below show the total amount collected, the number of transactions and the average gift size broken down by payment type on Keela’s platform.

Most organizations have a donor base predominantly made up of donors aged 50+. Statistically, it’s shown that these donors prefer to pay by traditional means: i.e., cheque or cash. This can be broken down further - the larger the gift size, the more likely it is to be donated via these traditional methods.

Bonus: Larger gifts avoid high processing fees!

On the other side of the coin, smaller, more ‘impulse’ based donations are rising in popularity. To facilitate these transactions, third-party platforms like Stripe and Paypal are also on the rise. They enable quick, easy donations on-the-go and their transaction fees are much lower than previous, traditional methods.

What is evident from these graphs is that credit card payments are increasingly being replaced by third party processors, although credit cards still make up a substantial part of donations. But whatever way you look at it, virtual payments are rising, which is fuelling a system where younger donors are becoming more prominent members of the giving landscape; donors who are more tech-versed, who prefer being cultivated in innovative ways, and care deeply about where their money is going - regardless of whether it’s $10 or $1,000.

We see this most prominently in humanitarian crises. After the Haiti earthquake in 2010, fundraisers collected over $30 million from text message donations alone.

And the true power of microdonations come not just from their volume, but from the power of sharing. One out of five donors share a campaign following their donation. Each share averaged around $15, which in many cases, can equate to up to 50% of a campaign’s donation volume!

Now your microdonations suddenly seem a lot more...macro.

How to make sure you’re set up to receive more microdonations

As your organization prepares for the year ahead, the most important takeaway from this is to diversify your fundraising sources. The more channels you have for collecting payments, the better. This way all corners of your constituency map are covered; from Boomers to Gen Z.

Still unsure? Think of these transactions within the same context as communications. Not all donors like to receive the same types of communications, just like not all donors want to give the same way. You risk alienating a donor by not offering them a transaction channel they’re comfortable with.

While large donations may still make up the lion’s share of your revenue, the future of philanthropy is giving us clear signals towards the power of microdonations, and the power of a population that is engaged, connected, and trying to make a difference with their dollar.

Guest contributions represent the personal opinions and insights of the authors and may not reflect the views or opinions of Imagine Canada.

A storyteller by nature and an organizer by inheritance, Sam enjoys crafting meaningful content equally as much as colour coding spreadsheets. As the Marketing Director at Keela, a Canadian Donor Management Software (CRM), she is always on the hunt for new and innovative ways to educate nonprofits and help them maximize their impact.