Like anything in life, if you generate 100% of your revenue from one source, or even one type of source, your risk is higher than if you diversify.

Fundraising is no different.

Diversification in the realm of fundraising simply means, find a number of revenue sources and build streams of cash flow from each. Some examples of revenue sources include:

- Government and foundation grants

- Income from programs

- Individual giving

- Corporate giving

- Sponsorships

- Events

- Recurring or monthly giving programs

The fact is, the world is uncertain and you owe it to those you support to ensure that no single change in the world could wipe away your entire source of revenue.

There are countless stories about thriving nonprofits who rely solely on a large government grant each year. They do amazing work and help hundreds in their communities, but a shift in political leadership, for example, could lead to a cancellation of their grant. Programs can then shut down and the organization struggles to stay afloat.

It’s a sad tale but it’s not unique. Don’t fall into the trap of leaning on one source of revenue for more than 25% of your total. By that, it means no one grant, event, or donor should make up more than 25% of your total revenue.

Remember, individual giving can be a safer bet, as it’s unlikely that all individual donors will suddenly stop giving. However, if our current world climate is a lesson in risk prevention, even individual donors can be collectively hit hard by big economic events.

You must also consider the fact that many individuals have a certain percentage of their wealth earmarked as available to donate to a cause that captures their heart. If a large disaster occurs with no warning, those dollars that were once set to reach you will suddenly be shifted to aid the disaster relief. If you have a number of diversified streams of income, you’ll weather the storm more effectively than if you were relying on just one.

So how do you create a well-diversified fundraising plan? In this blog, we’ll run through an exercise that will help you identify whether or not you’re sufficiently diversifying your revenue streams!

Activity: Take a look at your own giving and tally up the sources of all the funds you received over the past 12 months. Fill in this easy-to-use calculator tool.

Once you have your table you can easily see how diversified your revenue sources are.

| Revenue Source | Total Revenue | % of Total |

|---|---|---|

| Ex. End of year gala | $60,000 | 25% |

| Ex. Recurring donation program | $25,000 | 10% |

| Ex. Major gifts | $55,000 | 23% |

| Ex. Corporate Program (VanCity Credit Union) | $100,000 | 42% |

| Total Revenue (all sources) | $240,000 |

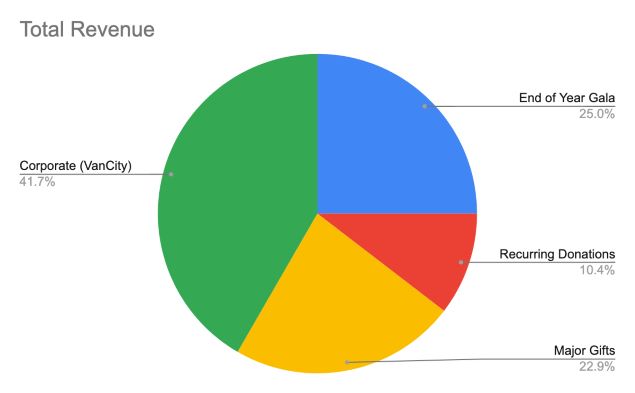

In the example above, 42% of revenue comes from this organization’s corporate giving program, with VanCity as their sole corporate funder. This indicates a diversification risk they will want to fix in the year ahead.

You can also build a visual representation of this table above in a pie chart, which can be powerful and convincing when you present your new strategy to your Board.

Watch Sandy Rees from GetFullyFunded walk you through this exercise in this short video. It’s essentially the same concept we outline above but in this video she walks you through it all step by step and shows you how to use it to guide your fundraising plan.

So what now?

If you notice your revenue sources are stacked heavily in one corner, it’s time to reassess your current fundraising plan. There’s no need to jeopardize your current revenue streams. Instead, try focusing any additional resources on growing recurring donations and setting up a major gifts program.

GetFullyFunded also describes the 1-10-1000 rule. The 1-10-1000 rule gives you a loose framework that can set you up to develop a well-diversified and scalable fundraising-based organization. The rule goes like this:

“Do one event a year, and do it really well! Get 10 grants or more, don’t leave grant money on the table. And finally, build a donor database of 1000 or more individuals and corporations.”

From this database, you’ll begin cultivating, stewarding and growing your donor base over time using your grant funding to start programs as proof of concept and fund your annual event.

That’s it! Or at least that’s a solid foundation from which you can grow.

Guest contributions represent the personal opinions and insights of the authors and may not reflect the views or opinions of Imagine Canada.

Tasi Gottschlag is the COO of Keela, a comprehensive nonprofit software platform that gives you powerful, intelligent tools to manage your donors, mobilize your volunteers, market your nonprofit, and raise more money. Tasi has an MBA from SFU and built and sold her first SAAS tech start-up in 2018. She is a passionate builder of businesses, loving all the moving pieces, intricate dynamics and systems that produce the results we see. In her free time she loves to race sailboats, read inspiring business books and play with her two amazing daughters.