What is Social Finance?

How and why are organizations using social finance? What are the barriers, and enablers of engaging with social finance? Read our new report for insights into the social finance ecosystem in Canada.

Discover social finance

Journey to Impact: Unlocking Purpose through Social Finance

Read the report to understand the enablers and barriers of social finance and through real-life examples, to explore how and why social purpose organizations engage in social finance.

Leveraging social finance: case studies

Join Leena Yahia and Rebecca Waterhouse as they delve into examples of social finance repayable investment and of organizations that are using social finance to help them achieve their mission.

Social finance & innovation

Dive into this podcast with guest Graham Singh for insights on social innovation which is on the rise in Canada, and expanding the range of possibilities for identifying solutions to complex social problems.

Key Research Highlights

We invite you to read the report for additional findings and insights, as well as a glossary that aims to clarify terms and concepts associated with the social finance sector.

1. Motivations for Engaging in Social Finance.

The main motivator for exploring social finance options is to diversify funding sources, access capital, and overcome challenges with traditional financing. The focus on social impact and sustainability drives organizations to seek tailored financial solutions and build collaborative partnerships - this is especially crucial for communities that face challenges in accessing financial products that align with their values.

2. Barriers and Enablers of Social Finance.

Limited financial track record, high transaction costs, and lack of accessible social finance products are factors that hinder organizations in their efforts to use social finance tools. Understanding and addressing these barriers are crucial for promoting inclusive and sustainable social finance practices. In contrast, a clearly defined social or environmental mission, visionary governance, impact measurement, and access to social finance products are all factors that facilitate the adoption, utilization, and success of social finance.

3. Hybrid Organizations Can Increase Organizational Resilience.

Hybrid organizations, which integrate for-profit and nonprofit activities, have become a common approach. By combining social and financial objectives, organizations generate sustainable solutions that drive positive impact while ensuring financial viability.

4. Role of Consultants.

Intermediaries, such as consultants, play an important role in enabling organizations to navigate and adopt social finance, by providing expertise, conducting market research, facilitating impact measurement, building partnerships, and supporting policy development.

HOW ARE ORGANIZATIONS USING SOCIAL FINANCE?

Nonprofit organizations engage in social finance to diversify funding sources, access capital, and overcome challenges with traditional financing models. The $755 million Social Finance Fund (SFF) launched by the federal government will make flexible financing more accessible than ever for charities, nonprofits, and social enterprises.

To better understand social finance and its benefits, explore real-life examples of organizations that have utilized it and shared their journeys. Delve into their stories to gain insights from their experiences, lessons learned, and best practices.

Unlocking organizational potential for impact

Centering Indigenous knowledges, values, and worldviews to realize community-level change

$2.5 million community bond campaign

More resources

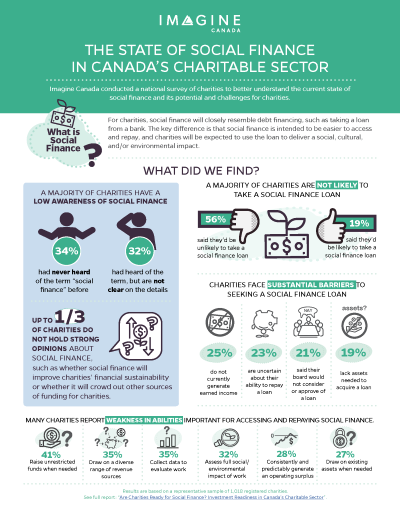

Based on a survey conducted in early 2020, this report provides a comprehensive look at the challenges, barriers, and opportunities for Canadian charities with respect to social finance. The report includes data on the level of awareness of social finance; the likelihood of taking a social finance loan; barriers to engaging in social finance; and charities’ financing needs.

A two-page infographic presenting key findings from our 2020 survey on the investment readiness of Canadian charities.