For more information about the supports discussed below, please visit our regularly updated blog post, Updates on federal supports for charities and nonprofits.

On November 10, 2020, Imagine Canada hosted a convening with 30+ charitable and nonprofit organizations to discuss how federal COVID-19 supports – mainly the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Rent Subsidy (CERS), and the Canada Emergency Business Account (CEBA) – could be improved, and what resources and initiatives would help more organizations access much-needed relief. Here is what attendees told us:

Challenges with existing supports

Canada Emergency Wage Subsidy (CEWS)

- Lack of clarity. The program can be complicated and confusing to understand. It is particularly challenging to determine program eligibility and what to include in revenue decline calculations.

- Irregular revenue patterns. Organizations do not always receive/earn revenues the same time each year, which can make month-to-month comparisons across two years challenging. This can result in delayed access to the subsidy.

- Lack of capacity. Many organizations (especially smaller organizations) do not have time to apply - and perceive application requirements to be burdensome. Time is especially tight for organizations experiencing increased demand for their services. Additionally, organizations may lack the financial knowledge and skills to understand rules and perform calculations required.

- Independent contractors not covered. Independent contractors are not considered eligible employees, and therefore are not covered by the subsidy. Given the precarious funding environment for charities and nonprofits, these workers comprise a non-negligible part of the sector’s workforce, especially in the arts & culture sub-sector.

- Uncertainty. “Managing for the unknown” is a major challenge, and organizations are worried for what happens when these federal supports expire. Not knowing what the program will look like beyond December 19, 2020 makes it difficult to forecast and budget.

Canada Emergency Rent Subsidy (CERS)

- Concerns program will be complicated and cumbersome. Given similarities to CEWS in design and implementation, many of the challenges with the CEWS noted above may apply to the CERS.

- Eligibility criteria for Lockdown Support too stringent. This additional support of 25% would not be available to organizations able to carry on activities in spite of public health order restrictions, even if at a significantly reduced capacity, and this is too strict.

- Unclear about definition of “commercial.” There is a lack of clarity as to how “commercial” will be defined in the CERS and whether it would render organizations that lease with not-for-profits (among other organizations) ineligible for the program.

Canada Emergency Business Account (CEBA)

- Denied access despite being eligible. Organizations report being turned away by financial institutions despite meeting eligibility criteria.

- Lack capacity to take loan. Many organizations lack cash flow required to make repayments and repayment schedules may be too short.

- Larger organizations ineligible. Organizations that exceed paid employment income cap are not eligible and supports available for these organizations are lacking.

What can be done to improve existing supports?

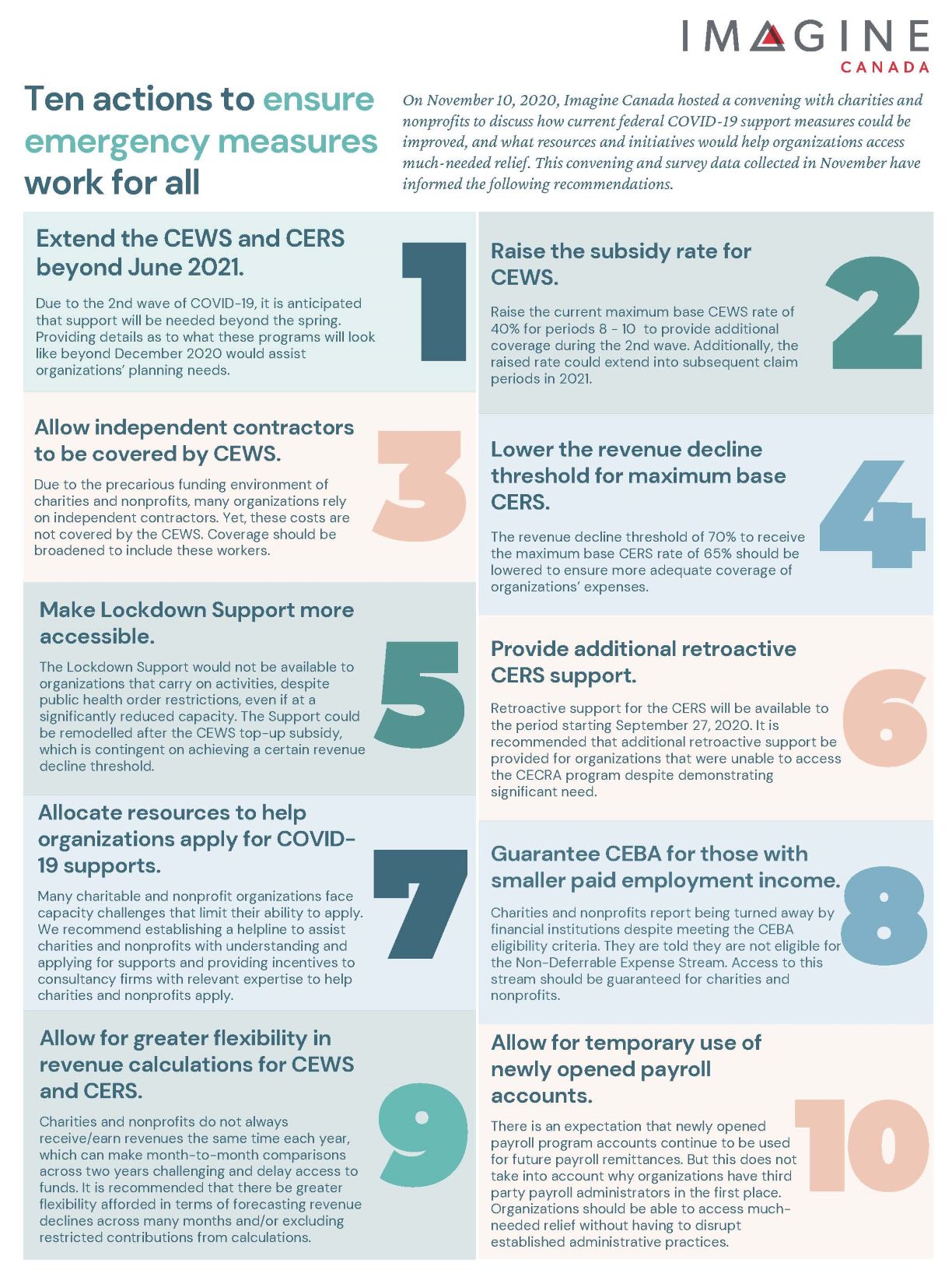

Attendees discussed how these supports can be improved. Based on their insights, Imagine Canada has developed a set of 10 recommendations to the Government of Canada to improve existing federal COVID-19 support measures.

Download this summary chart.

In addition to improving these supports, sector umbrella organizations like Imagine Canada and ONN play an important role in sharing information and resources to ensure that organizations are kept up-to-date with accurate information about these programs. These organizations and other stakeholders (including governments) can improve their communications by taking note of the following issues identified by attendees with how information and resources about support measures have been communicated thus far:

- Lack of timely communication. Organizations are not kept up-to-date about federal supports and it is very difficult to get current information in a timely manner. Regularly updated information about these programs would be helpful.

- Difficult to establish relevancy of information due to frequent program changes. Program changes are not communicated properly. New information is not dated or otherwise marked to indicate that it is new information, which leads to confusion regarding which information is relevant and which isn’t.

- Concerns about clarity and accuracy of information. Information is not always clearly presented, and inaccuracies will arise from individual sources that misinterpret programs.

- Charity and nonprofit eligibility not clearly communicated. It is not always clear which programs are available to charities and nonprofits. This information needs to be communicated upfront and distinctly.

- Lack of central repository for information. The volume of information and information sources is overwhelming, and therefore having a single location where everything about federal supports for charities and nonprofits can be found would be ideal.

- Information is too generic. There is a lack of charity- and nonprofit-specific information about federal supports.

Attendees generated many ideas of resources that could help improve understanding of and access to these supports. Chief among these ideas were:

- Sector helpline for COVID-19 supports. A dedicated concierge or helpline within federal government for charities and nonprofits to provide information and answer questions about federal COVID-19 supports. Ideally the helpline would be staffed by people who understand the sector.

- Consultancy support for organizations. Incentives could be offered to accounting firms and other organizations/institutions to provide advice and supports to help organizations access funding.

Other resources that could be helpful include:

- Step-by-step guides on how to apply

- Recorded Q&A webinars

- Sector stakeholder convenings to surface challenges/issues with supports

- E-mail bulletins and newsletters communicating information about supports

- Sub-sector specific information about supports

- Targeted communications to organizations directly affected by policy / program changes

- Rolling document that provides updated information on continual basis

- Series of townhalls with government officials that provide up-to-date information to sector organizations

- Application help groups

- Online training to help smaller organizations apply

What other supports does the sector need?

While improving the above-mentioned support measures is critical, what is clear from the convening is that the sector needs additional support.

Attendees told us these supports do not comprehensively cover the broad range of operational costs incurred by charities and nonprofits, such as transportation, communications, insurance, pension contributions, fundraising, vendor contracts, etc. Nor do they account for the increased costs of delivering services and carrying out other charitable activities, in particular IT and PPE - yet these are essential for continuing to operate effectively in the midst of a pandemic.

Attendees expressed the need for stabilization funding for the sector (in the form of unrestricted funding to cover operational expenses) and the importance of developing a path for the long-term sustainability of the sector.