In her opening remarks for the 2022 federal budget, Canada’s Deputy Prime Minister and Minister of Finance Chrystia Freeland states “[L]et me be very clear: We are absolutely determined that our debt-to-GDP ratio must continue to decline. Our pandemic deficits are and must continue to be reduced. The extraordinary debts we incurred to keep Canadians safe and solvent must be paid down.” This focus on reducing debt and deficit might signal the start of this conversation moving into the public debate. In this blog post, we will explore recent federal trends in debt and deficit levels and investigate how this has potential to impact the charitable and nonprofit sector. Lastly, we examine paths forwards for actors in this sector, should they see a reduction in funding.

Federal trends in debt and deficit levels

In this context, deficit refers to government spending that exceeds their revenues over the fiscal year. Debt is the accumulation of annual deficits. Austerity is defined as a set of government policies that target reducing the deficit through spending cuts and/or tax increases. Although the budget does not seem to include substantial evidence of austerity measures, the government is winding down emergency COVID-19 expenditures.

Due to necessary emergency spending during the COVID-19 pandemic, the deficit increased to historic levels between 2019 and 2020, from $40.7 billion to $325.5 billion. According to the International Monetary Fund, Canada’s federal deficit-to-GDP ratio was the largest amongst the 35 high-income countries in 2020, almost two times higher than Australia’s and three times higher than Sweden’s and Ireland’s ratios. However, the deficit began to decrease as early as the fourth quarter of 2021. This decrease is due to surplus revenue generated by increased trade in consumer goods led by pharmaceutical and medical products and exports of energy products and motor vehicles and parts. The 2022 budget shows projections until 2026-27 that show a consistently decreasing projected deficit, from $113.8 billion in 2021-22 to $8.4 billion in 2026-27.

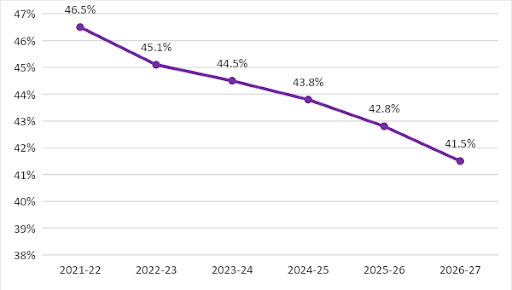

As of 2022, the national debt held by the federal government as a percent of gross domestic product (GDP) is 46.5% and projected to decrease to 41.5% in 2026-27. Despite the federal government signalling they intend to lower the debt-to-GDP ratio in the medium term, there remains little evidence that this focus on debt-to-GDP reduction is necessary. In fact, Canada has the lowest debt-to-GDP ratio of any G7 country. Furthermore, Modern Monetary Theory (MMT), a school of economic thought, challenges the notion that debt should be kept at a minimum and, instead, proposes that governments should not fear rising provincial or national debt. In essence, the theory states that sovereign countries that have full control over their currency can print as much money as they need since they hold a monopoly on the currency and can rely on policy choices to counter inflationary pressures. This heterodox macroeconomic framework implies that government debt should not be the primary focus so long as governments hold revenue generating assets as adequate collateral.

Graph 1: Projected Federal Debt as a % of GDP, 2021-22 – 2026-27

Relationship between federal spending and the charitable and nonprofit sector

The launch of a comprehensive Strategic Policy Review will identify opportunities to save and reallocate resources by adapting government programs and operations to a new post-pandemic reality. These changes include, notably, the increased capacity for virtual service delivery and remote work. This review should be on the radar of organizations that rely on government funding or that support the delivery of government programs. Even prior to this review taking place, organizations that saw an increase in funding during the pandemic due to the implementation of temporary recovery benefits will need to adapt their financial plans as those benefits expire.

In addition to impacting funding available to charities and nonprofits, the loss of pandemic recovery benefits will be felt by the millions of Canadians living below or near the poverty line. This reduction in spending will translate into increased demand for goods and services provided by the charitable and nonprofit sector at the same time as the sector itself may be facing reduced federal support. Funding constraints in this sector do not only impact services users; evidence from the austerity measures that followed the 2008 financial crisis found that the policies increased employment precarity for workers.

It is unclear how these impacts will translate at a provincial and territorial level since policies and funding commitments often depend on the ideology of the current party in government. The federal budget sets the expectations that all provinces will be expected to address the deficits incurred during the pandemic, although timing and scale is likely to differ regionally.

What can the charitable and nonprofit sector do to mitigate these impacts?

Put in this difficult position, there are a number of actions that the charitable and nonprofit sector can adopt to better respond to reductions in funding. Most importantly, organizations can continue to advocate for measures that address the root causes of social and environmental issues, such as poverty eradication and climate action. These measures would reduce the demand for their services, by remedying or preventing the conditions that require individuals and families to rely on charities and nonprofits. When organizations advocate for systemic change to support their service users, they signal their commitment to improving social conditions without centering themselves. The commitment to support redistribution of power increases perceptions of commitment and trust between service users and the community.

Although the conversation surrounding mergers and amalgamations rarely includes charities and nonprofits, it remains a tangible and often beneficial solution. When funding is scarce, merging can allow organizations offering similar or even identical services to collaborate, reducing the need for resources to sustain two organizational cultures. Mergers can also make navigating service use more accessible for community members, who might struggle to navigate a large number of similar supports. The same benefits that exist for service users apply to donors.

Research conducted in Canada and the United Kingdom following the 2008 financial crisis found that when austerity policies lead to reduced funding, the outcome is an increase in employment precarity in the form of temporary employment and under employment. The stress that results from increasingly precarious work shifts agency away from workers and towards management as vulnerable workers become less likely to voice concerns. Despite being a women-majority sector, women are underrepresented in the charitable and nonprofit sector’s leadership. Furthermore, immigrant, Indigenous and racialized women, women from the LGBTQ community, and women with disabilities are underrepresented in the sector’s leadership. Consequently, organizations must take concerted efforts to ensure that their organizational structure does not further entrench precarious labour in marginalized communities. In order to address workplace issues in the charitable and nonprofit sector, unionizing is an option that can empower workers through better working conditions, pay, benefits and control within the organization. In instances where the government is the primary funder, organizations can advocate for adequate core funding to enable them to have better working conditions and be able to better pursue their missions.

To summarize, with COVID-19 emergency benefits winding down and signals from the federal government that reducing debt and deficit will be a growing fiscal priority, charitable and nonprofit organizations might see a decrease in funding. As other levels of government reveal to what extent they will prioritize debt and deficit reduction, it will become increasingly clear how organizations will be impacted. In the past, reduced funding in the sector and cuts to social spending have meant a greater reliance on goods and services provided by the charitable and nonprofit sector, while unfortunately coupled with an increase in employment precarity within the sector. To avoid recreating those negative outcomes and to ensure organizations can continue to meet their clients’ needs, organizations might have to look to mergers or unions depending on what best suits their unique situation. As always, charities and nonprofits’ role in advocating for their clients’ needs remains central to ensure the best outcomes for all parties concerned.

Acknowledgements

This project was made possible thanks to generous support from our Lead Partner, BULLWEALTH.

BULLWEALTH is an investment advisory and consulting firm with a global perspective. At BULLWEALTH we invest our time to understand our clients needs and share our insights, so together we can make the most informed decisions that align with our clients investment goals. Insights means educating our clients to help them navigate through an often opaque financial world. We focus on delivering transparency and knowledge to help our clients understand their investment portfolio. We are committed to always having the highest level of integrity and remaining independent.