For more recent news about the Canada Emergency Wage Subsidy (CEWS) and other federal COVID-19 supports, please check out our blog, “Updates on Federal Supports for Charities and Nonprofits”

Note: The Government passed legislation in November that extends the program to June 2021.

Note: For claim periods 8 to 10, eligible employers are no longer required to calculate average monthly revenue over a three-month period. See our recent blog for more information.

Changes have been made to the Canada Emergency Wage Subsidy to broaden the reach of the program and make it easier for eligible employers, including charities and nonprofits, to access much-needed support during this time of crisis. The benefits to be gained from receiving wage subsidies can far outweigh the time and effort required to apply; this is a program that charities and nonprofits might really consider applying for. At the same time, the new iteration of the program is quite complex, so we wanted to break down the changes and what they mean for organizations.

What is the Canada Emergency Wage Subsidy (CEWS)?

The CEWS is a part of the Government of Canada’s COVID-19 Economic Response Plan. It is intended to help employers keep employees on the payroll and encourage employers to re-hire workers previously laid off by providing eligible employers with a wage subsidy.

What changes have been made?

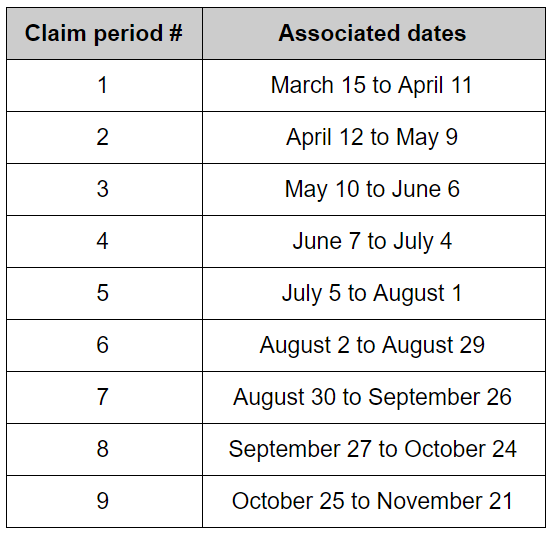

The following are some significant changes that were made to the CEWS in July 2020, which are effective as of July 5, 2020 (see the table below for claim periods and associated dates):

- Program length extended. The CEWS has been extended until December 19, 2020, although the recent rule changes are currently only applicable until November 21, 2020.

- Base subsidy for active employees. Eligible employers experiencing any revenue decline may receive a base subsidy, the amount of which will vary depending on the scale of the revenue decline.

- A top-up subsidy for active employees. A top-up subsidy of up to 25% is now available for eligible employers with a three-month average revenue drop of 50% or greater. The top-up subsidy rate is added to the base subsidy rate to determine the overall subsidy rate (this could allow eligible employers to receive a subsidy rate of greater than 75% for claim periods 5 and 6).

- Safe harbour rule. For claim periods 5 and 6, an eligible employer with a revenue decline of 30% or greater is entitled to a subsidy rate of at least 75% (the rate that was available in claim periods 1 through 4). This applies to both active employees and furloughed employees (i.e., employees on leave with pay).

What is the effect of the changes?

What is the effect of the changes?

Prior to the announced extension, many were concerned about program length given the continuing economic turmoil. Charities and nonprofits were especially concerned about projected revenues for the fall, which is normally an important fundraising period. The extension of the CEWS to December 19, 2020 partially addresses these concerns - the nature of not-for-profit business models and revenue patterns still present challenges.

In claim periods 1 through 4, eligible employers had to meet a revenue decline threshold of 30%. If they didn’t, they didn’t receive any support. Now, with the addition of the base subsidy, employers with any revenue decline greater than 0% can apply, dealing with concerns that the threshold was too high.

While the redesign of the program may make it easier for eligible employers to receive a subsidy, the redesign has also made the program more complex. Applying may be more difficult for organizations lacking HR capacity or expertise.

Imagine Canada will continue to monitor the impact of these changes on charities and nonprofits. If you have had an experience related to the CEWS that you would like to share with us, please contact us directly at [email protected]

Stay up-to-date

Visit our Wage Subsidy FAQ for more information in the form of commonly asked questions.

Sign-up for Imagine Canada’s Early Alert newsletter to stay informed about CEWS and other COVID-19 relief measures, or contact Imagine Canada directly at [email protected]