Social Finance Case Studies

22 organizations at different stages of investment readiness shared their social finance journeys with us. Read their stories to find out about their unique experiences, the lessons they learned, and the best practices they shared.

These 22 inspiring case studies, featured in the social finance report Journey to Impact: Unlocking Purpose through Social Finance, showcase the transformative potential of social finance. Each case study summarizes the organization’s journey, its investment readiness stage, and how social finance has played a crucial role in helping achieve its mission.

These case studies provide valuable insights, through direct quotes from participants, best practices, and key lessons. We hope that sharing these success stories will inspire other organizations to explore and harness the untapped potential of social finance!

Explore the case studies

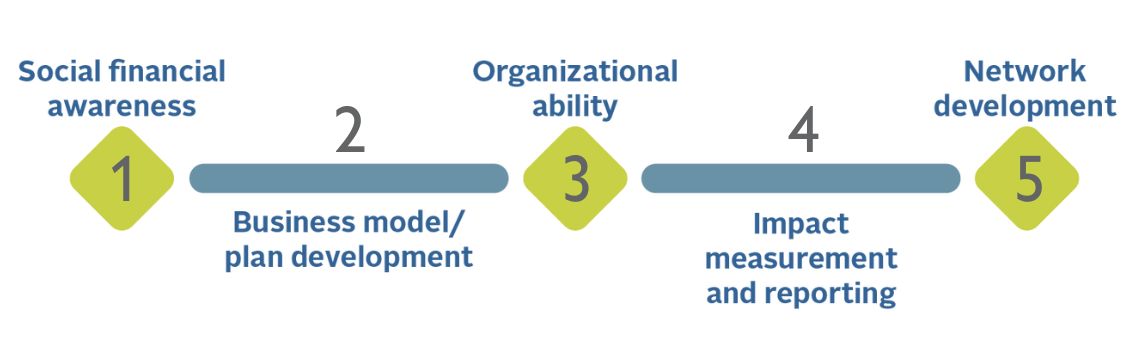

The case studies are grouped by their position on the investment readiness continuum.

Empowering churches: Unleashing capital for sustainable community transformation

Readiness stage: 1

Approach: capacity building, non-repayable capital

Unlocking organizational potential for impact

Readiness stage: 2

Approach:

capacity building through training

Building resilient communities through youth-led initiatives

Readiness stage: 2

Approach:

enterprise activity

Increasing access and financial inclusion for Muslims in Canada and beyond

Readiness stage: 3

Approach:

technical assistance

Prioritizing equity in every aspect, including the pay scale for consulting

Readiness stage: 3

Approach:

sliding pay scale

A successful journey to purchasing 42 Carden Street

Readiness stage: 5

Approach:

community bond

Fighting homelessness and predatory lending, one loan at a time

Readiness stage: 5

Approach: microfinance, interest-free loans, non-repayable grants

Building change makers and catalysing potential

Readiness stage: 5

Approach: technical assistance, non-repayable capital

Furnishing homes. Maximizing Impact. Building a national network

Readiness stage: 5

Approach: non-repayable capital, enterprise activity

Unleashing the beauty of Nova Scotia’s trails

Readiness level: 5

Approach:

enterprise activity

Transforming urban landscapes with sustainable solutions

Readiness stage: 5

Approach: non-repayable capital, enterprise activity

Increasing livelihoods and long-term resilience through entrepreneurship

Readiness stage: 5

Approach: debt financing, innovation fund, social impact bond

Catalyzing the innovation ecosystem for social and economic impact

Readiness stage: 5

Approach:

technical assistance, non-repayable capital

Fully committed to impact: Investing for a better world

Readiness level: 5

Approach: impact investing, grants, non-repayable capital, loan guarantees, social impact bond

Empowering growth. Building together.

Readiness stage: 5

Approach:

technical assistance, non-repayable capital

Empowering local impact: Transforming philanthropy through place-based solutions

Readiness level: 5

Approach: affordable loans, community bond, non-repayable capital

Innovating finance for a better world

Readiness level: 5

Approach:

technical assistance

Centering Indigenous knowledges, values, and worldviews to realize community-level change

Readiness stage: 5

Approach: technical assistance, outcome-based finance

Powering communities with community-owned solar systems for a brighter and cleaner future

Readiness level: 5

Approach: non-repayable capital, enterprise activity

Increasing fresh food access in under served communities

Readiness stage: 5

Approach: non-repayable capital, enterprise activity

Soup with purpose, empowering abilities

Readiness level: 5

Approach: interest-free loans, non-repayable capital, enterprise activity

The $2.5 million community bond campaign

Readiness level: 5

Approach:

community bond