In Canada, the Alternative Minimum Tax is the regular income tax formula’s lesser-known twin. Often abbreviated as AMT, this alternate tax calculation method is designed to ensure that everybody pays at least a minimum amount when tax season rolls around by applying a formula that is less affected by tax breaks.

In Budget 2023, the government of Canada introduced some changes to the AMT formula that may impact how the nonprofit and charitable sector receives donations, particularly large gifts.

What is the AMT and how is it changing?

When determining the amount of tax an individual must pay, the Canada Revenue Agency (CRA) performs two calculations: the regular calculation, and the Alternative Minimum Tax calculation. The higher of the two amounts is what the individual must pay.

The regular method of tax calculation considers all the individual’s preferential tax credits and deductions – expenses that can help lower the final amount of taxes owed – and then applies a tax rate between 15% to 33% based on that individual’s annual income. For most Canadians, this is the method used to determine the amount of taxes they pay.

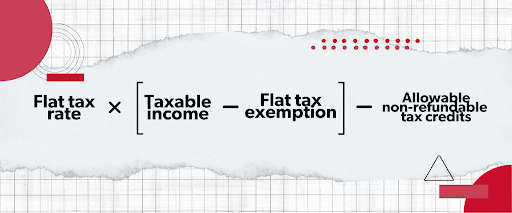

Budget 2023’s proposed changes do not affect the regular tax calculation method, but do concern the alternate formula used by the AMT. This formula was created in order to establish a minimum lower limit for taxpayers who are significantly benefiting from tax breaks. In other words, it limits the reductions that taxpayers are able to receive from credits or deductions. This is accomplished by adjusting taxable income and considering only the amount that exceeds a flat exemption, applying a low flat tax rate, and finally subtracting a reduced percentage of the individual’s credits and deductions to get the final amount owed. The formula is designed to primarily affect high-income Canadians or Canadians benefitting significantly from preferential tax breaks.

Although the alternative calculation is performed for everyone, the AMT is only triggered when the AMT calculation returns a higher amount than the regular calculation. Whatever the case, individuals pay either the regular amount or the AMT amount – never both.

Below is the formula used to calculate the AMT:

Under the new model proposed by the 2023 federal budget, the AMT formula will raise its flat exemption from the current $40 000 to a new exemption of $173 000. This raises the base amount of income an individual would need to trigger the AMT. It will also raise the flat tax rate from 15% to 20.5%, meaning the AMT is still calculated at a low rate, but no longer the lowest.

Budget 2023 also proposed several amendments for calculating the adjusted taxable income for AMT purposes. Notably for the nonprofit sector, only 50% of non-refundable tax credits, such as the credits an individual would receive from donating to registered charities, will be included in the AMT calculation. Previously, 100% of non-refundable tax credits were included. Additionally, 30% of capital gains from donations of publicly listed securities (e.g. stocks, bonds, preferred shares, ETFs) will be included. Previously, 0% of capital gains were included.

How might these changes affect the nonprofit sector?

The AMT changes proposed by Budget 2023 will reduce the financial incentive for individuals to make large donations to charities, as only 50% of non-refundable tax credits – the type of credit received from donating to registered charities – will now count towards reducing the AMT. Miller Thomson LLP provides a detailed illustration of how the same donation could result in a higher tax rate under the proposed AMT changes.

Large gifts may be particularly impacted. The AMT primarily affects wealthy individuals, who are the most likely to make large donations. As high-income Canadians respond to the lowered incentive for charitable donations caused by the AMT changes, there is an increased likelihood that large gifts to organizations in the charitable sector may be reduced, putting the sector in danger of losing a potential source of funding that many charities currently rely on.

To learn more, check out our submission on the AMT. To inform future advocacy, Imagine Canada is investigating the potential impact of the proposed AMT changes on the charitable sector. If you or your organization have thoughts on how the proposed changes to the AMT may impact your organization, we invite you to get in touch with us at publicpolicy@imaginecanada.ca.

Below we have included a list of resources which provide further commentary on Alternative Minimum Tax and the proposed impact to the Charitable and Nonprofit sector.

- Will Charities Suffer from the Proposed AMT Legislation? - Moodys Private Client

- New federal tax changes create major challenges for Canadian charities - Canada Gives

- Changes to the Alternative Minimum Tax as Proposed in Budget 2023 - Office of the Parliamentary Budget Officer